Why You Should Care About Where Your Savings Go

Most people know they should be saving money, but far fewer understand how dramatically the location of their savings can influence long-term outcomes. Sticking your money in a standard bank savings account might feel safe, but it can mean losing hundreds – or thousands – of dollars in potential growth.

High-yield savings accounts (HYSAs) aren’t just bank accounts with better branding. They offer 10–20 times the interest of traditional savings accounts. That’s money you’re missing out on if you don’t switch. In this guide, we’ll break down how HYSAs work, how to evaluate them beyond flashy APY numbers, and how to avoid common traps.

Whether you have $500 or $50,000, this is the knowledge that helps your money work harder for you.

Understanding APY: The Real Return on Your Savings

APY (Annual Percentage Yield) is the single most important figure when comparing savings accounts. Unlike a plain interest rate, APY includes the effect of compounding—the process by which the interest you earn also starts to earn interest. Think of it as a snowball effect for your money.

Let’s break it down:

- Example 1: $10,000 at 4.50% APY compounded annually becomes $10,450 after one year.

- Example 2: If the bank compounds monthly instead, you’ll earn slightly more—$10,459.51.

- Example 3: Over 3 years, $10,000 at 4.50% APY grows to $11,411.63.

Moral of the story? APY tells you how much your money actually grows in a year, assuming you leave it alone. Use it as your primary comparison tool.

Avoiding Hidden Fees: Because Interest Isn’t Everything

Even the most attractive APY can be rendered useless if hidden fees chip away at your balance. Many banks advertise “no fees,” but the fine print might say otherwise. Common culprits include:

- Monthly maintenance fees

- Excess transaction fees (for more than 6 withdrawals/month)

- Wire transfer charges

- Returned check fees

Let’s say your account earns $50 a year in interest—but you pay $5/month in fees. That’s $60 lost annually. You’re down $10 instead of up $50. Always read the disclosures. A slightly lower APY on a fee-free account often wins in the long run.

Minimum Balances: Don’t Fall for Rate Traps

Many high-yield savings accounts promote eye-catching APYs that are only available if you keep a certain amount in your account. Miss that threshold, and your rate could plummet—or worse, you might get charged a fee.

Consider these examples:

- Bread Savings: $100 minimum to earn 4.40% APY

- BrioDirect: $5,000 minimum for 4.50% APY

- EverBank: No minimum balance for 4.30% APY

If you’re planning to park $200, BrioDirect’s high APY won’t help you. Choose an account that fits your realistic financial habits, not your ideal scenario.

Online Banks vs. Traditional Banks: The Trade-Offs

Online banks often offer better rates because they don’t have to maintain branches. But that doesn’t mean they’re always better. Consider:

- Online banks: Higher APYs, lower fees, digital-only service

- Traditional banks: Branch access, ATM networks, better for complex transactions

If you’re comfortable banking from your phone and don’t need in-person help, go digital. Otherwise, a hybrid strategy—using an online HYSA for savings and a traditional bank for daily needs—can be a smart move.

Accessibility: How Easily Can You Tap Your Savings?

A high APY is meaningless if it’s a pain to get your money out. Not all HYSAs are equal when it comes to flexibility. Ask yourself:

- Can you link to external bank accounts?

- How long do transfers take?

- Are there withdrawal limits or delays?

- Is there ATM or debit card access?

Some accounts, like UFB Direct, offer ATM cards with savings accounts. Others, like Marcus by Goldman Sachs, limit how many transfers you can make each month. Choose based on how often you need access—and how quickly.

Federal Insurance: Don’t Gamble with Your Nest Egg

One of the core advantages of savings accounts is safety. But make sure your chosen institution offers federal insurance:

- FDIC (banks): Covers up to $250,000 per depositor, per institution

- NCUA (credit unions): Offers the same protection

Check for this logo or statement when signing up. It guarantees that even if the bank fails, your money is protected.

Interest and Taxes: What You Earn Isn’t What You Keep

All interest earned in HYSAs is taxable income. If you earn more than $10 in a year, your bank will send you a 1099-INT form. Here’s how it can play out:

- Earn $500 in interest at 24% income tax rate = $120 owed to the IRS

- Net interest after tax: $380

To maximize your return, consider using HYSAs for emergency funds and CDs or tax-advantaged accounts for larger, longer-term savings.

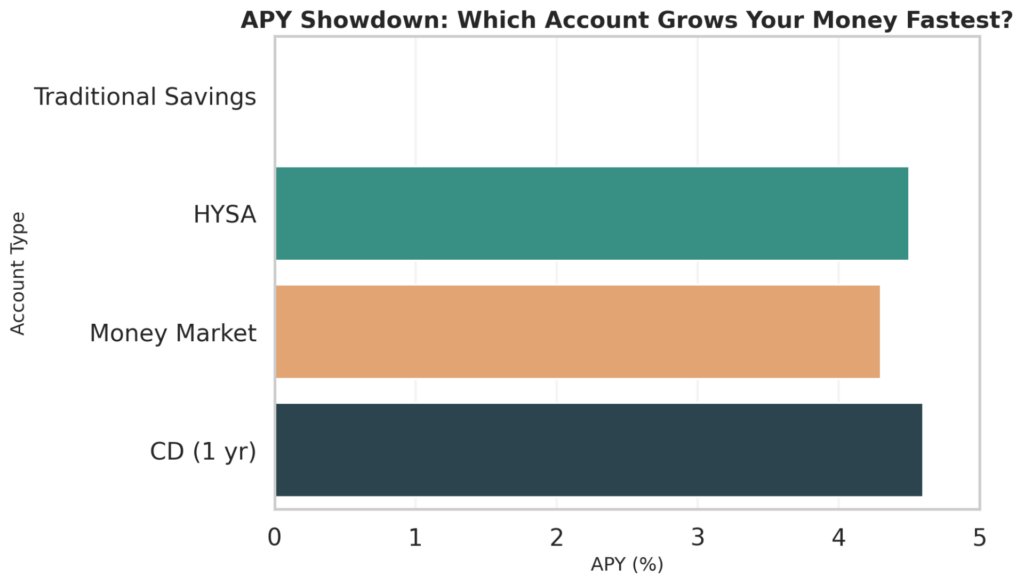

Comparing Account Types: What’s Best for Your Strategy?

It helps to know how HYSAs stack up against other account types:

- HYSAs: Flexible, high yield, best for emergency or short-term funds

- Money Market Accounts: Hybrid savings/checking, often with debit cards

- Certificates of Deposit (CDs): Higher fixed rates, but money is locked for months or years

- Checking Accounts: Daily spending, low to no interest

For example, if you’re saving for a vacation in 6 months, use an HYSA. If you’re saving for a house in 3 years, a CD ladder might make more sense.

Top 10 High-Yield Savings Accounts (April 2025)

- Pibank – 4.60% APY – No minimum deposit, no fees, online-only

- Vibrant Credit Union – 4.50% APY – No minimum, membership required, NCUA insured

- Poppy Bank – 4.50% APY – Online/branch access, no minimum

- Fitness Bank – Up to 4.55% APY – Step-tracking model, mobile-based

- BrioDirect – 4.50% APY – $5,000 minimum, online access

- Bread Savings – 4.40% APY – $100 minimum, no fees

- Bask Bank – 4.35% APY – No minimum, easy setup

- CIT Bank – 4.10% APY – $100 minimum deposit

- SoFi – Up to 3.80% APY – Hybrid checking/savings, bonuses with direct deposit

- American Express Savings – 3.70% APY – No fees, highly reputable

Final Thoughts: A Smart Saver Is an Informed One

A high-yield savings account isn’t just a place to park cash—it’s a tool to build wealth with low risk and high flexibility. In today’s market, where inflation eats into idle funds and market volatility can derail investments, HYSAs offer a rare combination of growth, safety, and accessibility. By choosing the right account—and understanding all the moving parts—you’re doing more than saving. You’re optimizing. And that’s how smart money grows.