Savings accounts are one of the most basic financial tools, but don’t let their simplicity fool you – they’re incredibly useful and worth optimizing. In essence, a savings account is a place to store money you don’t need for day-to-day expenses, while earning a small return on your balance over time. Banks and credit unions offer these accounts to customers as a safe, low-risk way to earn interest, and they’re typically insured by the FDIC or NCUA up to $250,000 – so even if the bank goes under, your money doesn’t.

Let’s make that tangible with a few quick examples:

Example 1: Modest Saver

You deposit $1,000 into a savings account with a 4.50% APY.

- After 1 year:

$1,000 × (1 + 0.045) = $1,045.00 - You earned $45 in interest by doing… absolutely nothing.

Example 2: Bigger Nest Egg

You deposit $10,000 at 4.60% APY and leave it for 3 years, compounding annually:

- Year 1: $10,000 × 1.046 = $10,460

- Year 2: $10,460 × 1.046 = $10,942.16

- Year 3: $10,942.16 × 1.046 = $11,445.48

That’s $1,445.48 in passive growth – again, just for letting your money sit in a good account.

Now imagine you had $50K or more. Interest becomes a significant source of risk-free income, especially when compared to checking accounts (which often pay 0%).

What Does the Interest Rate (APY) Actually Mean?

When we talk about interest on savings accounts, we’re mostly referring to APY, or Annual Percentage Yield. This is the rate of return you’ll earn on your money over the course of one year, assuming that the interest is compounded (i.e., added to your balance and itself starts earning interest). It’s a little nerdy – but fun – because the magic of compounding interest means your money doesn’t just grow; it accelerates over time.

Why Are Rates So High Right Now?

Historically, savings account rates have hovered anywhere from 0.01% (basically nothing) to around 2%. But lately, we’re seeing APYs over 4%, which is unusually high. Why?

It all comes down to macroeconomic conditions—specifically, central bank interest rates. In the U.S., the Federal Reserve raised its benchmark rate several times in recent years to combat inflation. When that happens, banks also raise the rates they offer savers, partly to stay competitive and partly to fund their own lending operations at higher margins.

But here’s the twist: these high rates won’t last forever. As inflation cools and the economy adjusts, the Fed is likely to cut rates. When that happens, banks will follow, and these juicy APYs could shrink fast. That’s why now is a great time to act if you’re sitting on idle cash.

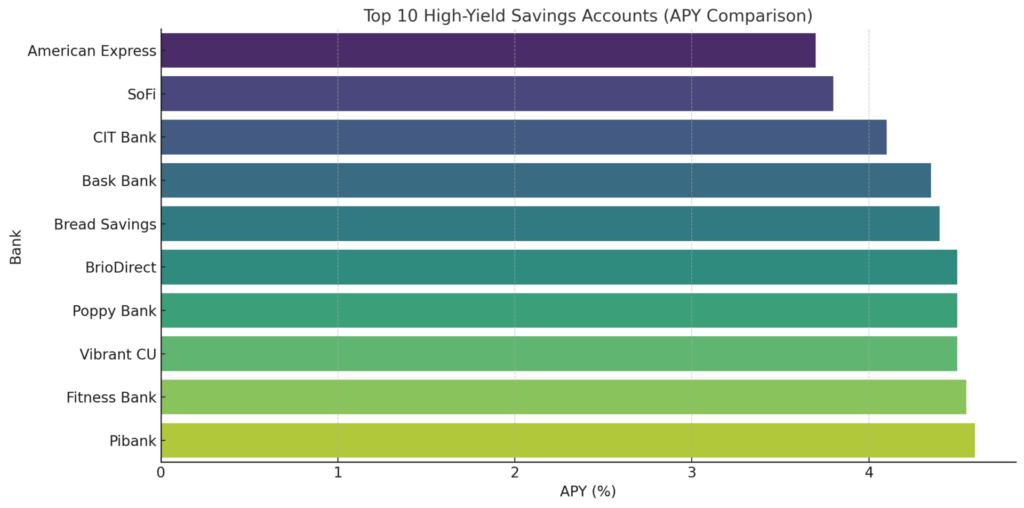

10. American Express® High Yield Savings

American Express is a well-established financial institution known for its credit card products and customer service. Its high-yield savings account offers a competitive rate with no monthly fees or minimum balance requirements. While it lacks a checking account or ATM access, it remains an excellent digital savings tool. Transfers are handled electronically through linked accounts, which may take a couple of business days. The bank holds a solid reputation score of 78.2, giving users confidence in its reliability.

- APY: 3.70%

- Reputation Score: 78.2 (5-Star Trust Rating)

- No minimum deposit

- No monthly fees

- FDIC insured

- Online-only access

9. SoFi Checking and Savings

SoFi has gained popularity as a digital finance platform, especially among younger and tech-savvy customers. Their hybrid checking and savings account provides an APY up to 3.80% when you set up direct deposit. It includes a generous welcome bonus and allows you to manage all your finances through a single mobile app. The account is FDIC insured and fee-free, making it a convenient choice for those comfortable with online banking. Although the bank’s trust score isn’t specified, its market reputation and user satisfaction are generally strong.

- APY: Up to 3.80%

- No minimum balance for APY

- Up to $300 bonus with direct deposit

- FDIC insured

- Mobile and online banking

8. CIT Bank Savings Connect

CIT Bank is a digital-only institution known for providing above-average rates and a streamlined account setup. The Savings Connect account offers a 4.10% APY, placing it slightly above mainstream competitors. A $100 minimum opening deposit is required, but there are no monthly maintenance fees. Though physical branch access isn’t available, the mobile and web interface is easy to use. CIT Bank doesn’t publish a reputation score, but it is FDIC insured and trusted in the online banking space.

- APY: 4.10%

- $100 minimum deposit to open

- No monthly fees

- FDIC insured

- Online-only access

7. Bask Bank Interest Savings Account

Bask Bank has carved out a niche for offering savings options tailored to digital-first users. Its high-yield interest savings account provides a 4.35% APY without requiring a minimum deposit. With no monthly fees and FDIC insurance, it’s ideal for passive savers seeking strong returns with minimal effort. Users must be comfortable managing funds via a digital interface, as there are no physical branches. Though it lacks a reputation score, it is a subsidiary of Texas Capital Bank, adding legitimacy.

- APY: 4.35%

- No minimum deposit

- No monthly fees

- FDIC insured

- Online-only access

6. Bread Savings High-Yield Savings Account

Bread Savings, offered by Comenity Capital Bank, delivers a highly competitive APY of 4.40%. It’s geared toward savers willing to make a small initial deposit—$100—to unlock strong earnings potential. There are no monthly fees, and the account is managed entirely online. Bread Savings focuses on simplicity and automation, with limited bells and whistles. The bank’s reputation is growing, especially among those who prioritize high returns over traditional banking features.

- APY: 4.40%

- $100 minimum deposit to open

- No monthly fees

- FDIC insured

- Online-only access

5. BrioDirect High-Yield Savings

BrioDirect offers one of the stronger APYs in the mid-tier range at 4.50%. However, it requires a fairly high minimum opening deposit of $5,000, making it more suitable for established savers. The account carries no monthly maintenance fees and is accessible entirely online. BrioDirect is a division of Sterling National Bank, which gives it an additional layer of credibility. It’s best suited for users who can meet the deposit threshold and want to maximize interest earnings.

- APY: 4.50%

- $5,000 minimum deposit to open

- No monthly fees

- FDIC insured

- Online-only access

4. Fitness Bank Savings Account

Fitness Bank takes a unique approach by tying APY to the account holder’s physical activity, incentivizing daily movement. Customers can earn up to 4.55% APY by meeting step goals tracked via a mobile app. This creative twist makes it ideal for active individuals who want to align financial and fitness goals. There are no monthly fees, and the bank is FDIC insured. However, those who don’t meet the fitness targets will see lower returns.

- APY: Up to 4.55%

- APY based on monthly step count

- No monthly fees

- FDIC insured

- Mobile and online access

3. Poppy Bank High-Yield Savings

Poppy Bank offers a solid APY of 4.50% with no minimum deposit requirement, making it both accessible and profitable. It combines the convenience of digital access with the security of in-branch support for those in California. The bank has a strong financial background and caters to both personal and business customers. While trust scores are not readily published, Poppy Bank has a stable community presence. This account is suitable for users looking for a blend of digital and traditional banking.

- APY: 4.50%

- No minimum deposit

- No monthly fees

- FDIC insured

- Online and branch access

2. Vibrant Credit Union High-Yield Savings

Vibrant Credit Union provides an impressive APY of 4.50%, accessible to all members with no deposit minimums. Membership is open to a broad range of applicants and includes NCUA insurance. Unlike many high-yield accounts, it combines strong digital functionality with access to credit union services. It’s a compelling option for those who value community banking and competitive rates. While specific trust scores are unavailable, credit unions like Vibrant tend to score highly in customer satisfaction surveys.

- APY: 4.50%

- No minimum deposit

- No monthly fees

- NCUA insured

- Membership required

- Online and branch access

1. Pibank High-Yield Savings Account

Topping the list is Pibank, offering a standout APY of 4.60% with no minimum balance or deposit requirements. This makes it highly appealing for savers at all levels, from beginners to seasoned investors. It is fully FDIC insured and managed online, offering an intuitive and secure banking experience. While it operates under the radar, Pibank is backed by a well-capitalized parent institution, giving it strong financial credibility. This offer currently leads the market for straightforward, high-interest savings.

- APY: 4.60%

- No minimum deposit

- No monthly fees

- FDIC insured

- Online-only access

TL;DR:

A savings account is a safe, liquid, interest-earning home for your money. Right now, due to a unique window of elevated interest rates, savers can earn over 4% APY, making it one of the best times in years to move cash into a high-yield account. And with just a little effort—and maybe a calculator—you can watch your money quietly and steadily grow.