Fixed Index Annuities & Finding the ‘Best’ Rates: A Simple Guide

Heard about an investment that offers the chance to grow your money based on market index gains (like the S&P 500) but without the risk of losing your principal if the market crashes? Sounds appealing, right? That’s the core promise of a Fixed Index Annuity (FIA). But how do they really work, especially when it comes to their growth potential or “rates”? And how do you find the “best” ones? Let’s break down this complex-sounding product into simple terms.

What is a Fixed Index Annuity (FIA)? The Basics

Think of an FIA as a contract between you and an insurance company. Here’s the gist:

- Safety Net: Your principal investment is generally protected from market downturns. If the linked index goes down, you typically don’t lose money (you might just earn zero interest for that period).

- Growth Potential: Your money has the potential to earn interest based on the performance of an external market index (like the S&P 500, Nasdaq 100, etc.). You choose the index(es) from options provided by the insurer.

- Indirect Link: You are not directly invested in the index itself (you don’t own stocks). Your interest crediting is simply calculated based on the index’s performance, subject to certain limits.

- Tax Deferral: Like other annuities, any interest earned grows tax-deferred until you start taking withdrawals, typically in retirement.

- Insurance Product: It’s fundamentally an insurance contract designed primarily for long-term goals, often retirement savings or income.

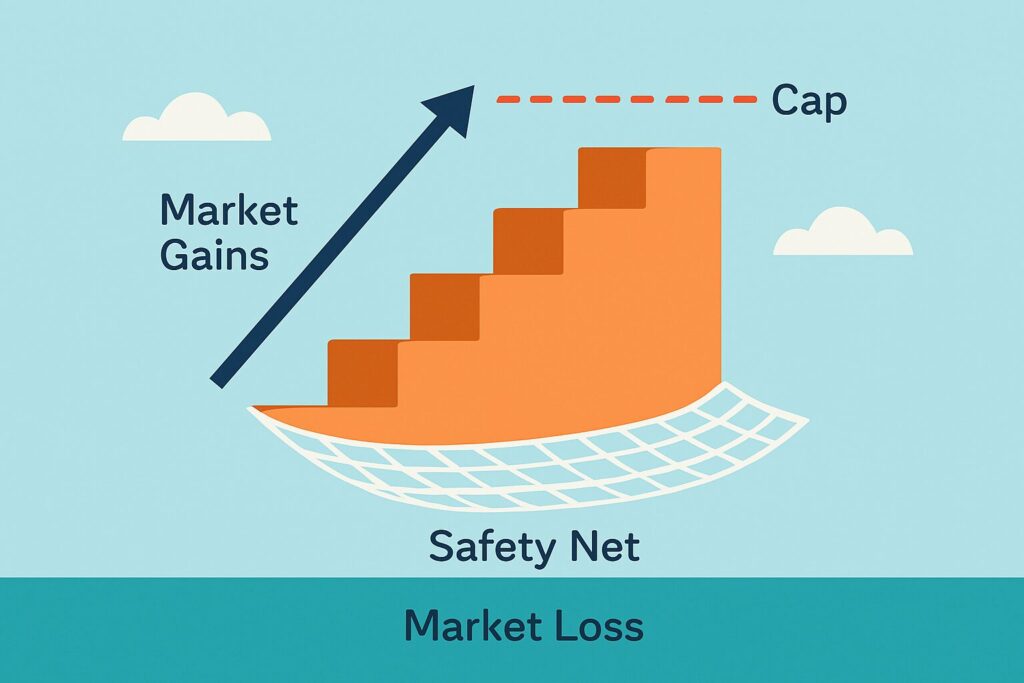

Analogy: Imagine climbing stairs (market gains) with a safety net below. With an FIA, the net catches you if you slip (market loss), ensuring you don’t fall below where you started that period. However, there might be a ceiling (a ‘cap’) limiting how high you can climb in one go, even if the actual staircase goes much higher.

The Upside Potential: How FIAs Can Grow (Caps, Participation Rates, Spreads)

This is where the “rates” come in, but it’s not a simple interest rate. Insurers use mechanisms that limit how much of the index’s gain you actually receive. Understanding these is crucial:

- Cap Rate (The Ceiling): This is the maximum rate of interest your annuity can be credited in a specific period, even if the linked index performs better.

- Example: If the Cap Rate is 8% and the index gains 12%, your credited interest is capped at 8%. If the index gains 5%, you get 5% (since it’s below the cap).

- Participation Rate (Your Share): This is the percentage of the index’s positive performance that is used to calculate your interest credit.

- Example: If the Participation Rate is 70% and the index gains 10%, your credited interest is 7% (70% of 10%). If there’s also a cap, you’d get the lower of the calculated amount or the cap.

- Spread Rate (or Margin Fee – The Hurdle): This is a percentage deducted from the index’s gain before interest is credited to your annuity.

- Example: If the Spread Rate is 2% and the index gains 9%, your credited interest is 7% (9% – 2%). If the index gains only 1.5%, you’d likely get 0% interest, as the gain didn’t overcome the spread.

Key Point! You do not get the full return of the market index with an FIA. These limits (Caps, Participation Rates, Spreads) are how the insurance company protects your principal and makes money. Different FIAs use different combinations of these – some might have only a Cap, some only a Participation Rate, some a Spread, or even a mix.

Insurers also use various Crediting Methods (like annual point-to-point, monthly averaging, etc.) to calculate the index change over a specific period (usually one year). The method used can also significantly impact the interest credited.

Finding Favorable ‘Rates’: What to Look For & Compare

So, how do you find the “best rates”? It means seeking out FIA contracts offering the most favorable combination of these crediting factors for the specific index and crediting method you choose. Generally:

- Higher Caps are better.

- Higher Participation Rates are better.

- Lower (or zero) Spreads are better.

However, it’s rarely that simple:

- Rates Can Change: The Caps, Participation Rates, and Spreads declared by the insurance company are often not guaranteed for the entire life of the annuity. They can typically be reset by the insurer, usually annually or at the start of each contract term (e.g., every year within a 10-year surrender period). The minimum guaranteed Cap/PR or maximum guaranteed Spread over the contract life is crucial information found in the contract details.

- Trade-offs Exist: An FIA offering a very high Cap on one index might have a lower Participation Rate on another, or it might come with higher fees for optional riders or a longer surrender charge period. There’s no free lunch.

- Illustrations are Key: Because rates vary and depend on the specific product, index, crediting method, and current market conditions, you cannot simply look up “FIA rates” like savings account rates. You need to get personalized illustrations from a licensed insurance agent or financial advisor for specific FIA products you are considering. These illustrations will show hypothetical performance based on historical index data and the current declared rates (Caps/PRs/Spreads) for that specific product.

When comparing FIA illustrations, focus on understanding the current declared rates, the guaranteed minimums/maximums for those rates over the contract life, and how different index choices or crediting methods impact potential outcomes.

Beyond Rates: Other Crucial Factors

Don’t focus solely on the potential upside limits. These factors are equally, if not more, important:

- Insurer Financial Strength: This is paramount. The guarantees and protections of an annuity are only as good as the insurance company backing them. Look for companies with high ratings from AM Best (A-, A, A+, A++) indicating strong financial health and ability to meet long-term obligations.

- Surrender Charges: FIAs are long-term contracts. If you withdraw more than a specified amount (often 10% per year) during the surrender charge period (which can last anywhere from 5 to 15+ years), you’ll pay a hefty penalty, starting high and declining over time. Understand the schedule clearly!

- Fees & Riders: While the core FIA might have no explicit annual fee, optional riders (like Guaranteed Lifetime Withdrawal Benefits – GLWBs, enhanced death benefits, etc.) come with annual costs, typically deducted from your account value (e.g., 1-1.5% per year). These rider fees reduce your net return. Be clear on all potential fees.

- Complexity: FIAs are complex contracts with intricate rules. Ensure you (and your advisor) fully understand how interest is credited, how fees work, withdrawal limitations, and rider provisions before committing.

Pros vs. Cons: Is an FIA Right for You?

Let’s summarize the trade-offs:

Potential Pros:

- Principal Protection: Your initial investment is generally protected from losses due to market index downturns.

- Tax Deferral: Earnings grow tax-deferred until withdrawn.

- Potential for Modest Growth: Opportunity to earn interest potentially higher than CDs or fixed annuities, based on index performance (up to the limits).

- Lifetime Income Options: Optional riders can provide a guaranteed stream of income for life, regardless of market performance (though fees apply).

Potential Cons:

- Complexity: Can be difficult to fully understand all the moving parts (crediting methods, caps, riders).

- Limited Upside: Caps, Participation Rates, and Spreads mean you won’t capture the full gains of a rising market index.

- Illiquidity: Surrender charges make accessing large sums difficult or costly during the surrender period (often many years).

- Fees for Riders: Optional income or death benefit riders add annual costs that reduce accumulation.

- May Underperform Direct Investment: In strong bull markets, direct stock market investments (like index funds) will likely outperform FIAs due to the FIA’s upside limitations.

Who Typically Considers an FIA?

FIAs generally appeal most to conservative investors who are nearing or already in retirement. Their primary goal is often capital preservation with the potential for some modest growth that might beat inflation, without risking market losses. They are also frequently used by individuals seeking guaranteed lifetime income through optional riders, providing a pension-like stream of payments. They are less suitable for younger investors with long time horizons who can tolerate more market risk for potentially higher growth through direct market investments.

FIA Growth Methods: How Gains Are Limited

| Limiting Factor | How it Works | Impact on Return | What’s ‘Better’? |

| Cap Rate | Maximum interest rate credited per period | Limits upside if index gain exceeds cap | Higher Cap |

| Participation Rate | % of index gain used to calculate interest | Limits upside by taking only a portion | Higher Rate (%) |

| Spread / Margin | % deducted from index gain before crediting interest | Limits upside by subtracting a hurdle | Lower/Zero Spread |

Important Note: This table simplifies complex crediting methods. Specific FIA products may use one or a combination of these factors, and the way index changes are measured also impacts results. Always review the specific product illustration and contract details. Information is subject to change. Conduct your own due diligence.

Key Takeaways

- Fixed Index Annuities (FIAs) offer principal protection from market loss while linking potential interest growth to a market index, subject to limits.

- The “rates” (Caps, Participation Rates, Spreads) determine how much of the index’s upside you capture; higher caps/PRs and lower spreads are generally more favorable.

- These rates can often be reset by the insurer (usually annually); focus on guaranteed minimums/maximums in the contract.

- FIAs are complex, long-term contracts with significant surrender charges for early withdrawals and potential fees for optional riders.

- Insurer financial strength (AM Best rating) is critical.

- Best suited for conservative investors prioritizing safety and potential lifetime income over maximizing market gains.

Conclusion: A Safety-Focused Tool Requiring Clarity

Fixed Index Annuities can be a useful tool for the right person – typically someone prioritizing principal safety above all else, seeking potential growth slightly above traditional fixed products, and possibly wanting guaranteed lifetime income via riders. However, their complexity and limitations on upside potential are significant trade-offs. Finding the “best rates” means diligently comparing illustrations for specific products, focusing on maximizing caps and participation rates while minimizing spreads, and understanding the guaranteed minimums. Crucially, weigh these potential crediting rates against the surrender charges, rider fees, and the financial strength of the issuing insurance company. Because of their complexity, it’s essential to work with a trusted financial professional who can thoroughly explain the specific contract you are considering and ensure it truly aligns with your long-term financial goals and risk tolerance. Remember to read the full contract carefully before making any decisions.

Glossary

- Fixed Index Annuity (FIA): An insurance contract that provides principal protection against market loss and credits interest based on the performance of a linked market index, subject to limitations like caps, participation rates, or spreads.

- Index: A benchmark used to measure the performance of a market segment (e.g., S&P 500 Index for large U.S. stocks). FIAs are linked to, but do not directly invest in, an index.

- Cap Rate: The maximum interest rate that will be credited to the annuity for a specific crediting period, even if the linked index performs better.

- Participation Rate (PR): The percentage of the linked index’s positive change that is used to calculate the interest credited to the annuity.

- Spread (or Margin): A percentage deducted from the linked index’s positive change before interest is credited.

- Surrender Charge: A penalty fee charged by the insurance company if the annuity owner withdraws more than a specified free withdrawal amount during the surrender charge period (typically the first 5-15+ years of the contract).

- Rider: An optional add-on to an annuity contract that provides additional benefits (like guaranteed lifetime income or enhanced death benefits) usually for an additional annual fee.

- Annuitization: The process of converting the annuity’s accumulated value into a stream of periodic income payments, often for life. (Distinct from lifetime income riders which allow withdrawals while maintaining account access).

- AM Best Rating: A letter grade assigned by the AM Best rating agency indicating an insurance company’s financial strength and ability to meet its obligations. Crucial for evaluating annuity providers.