Author: Ben Richardson

-

IRS Tax Forgiveness Requirements

Eligibility Criteria for Offer in Compromise To secure IRS tax forgiveness via an Offer in Compromise (OIC), meeting specific criteria is crucial: The IRS examines your income, expenses, assets, and potential future earnings. Bankruptcy proceedings or a history of tax evasion complicate forgiveness. Substantial assets may lead to immediate rejection. If OIC isn't suitable, consider:…

-

Debt Consolidation with Bad Credit

Understanding Debt Consolidation Debt consolidation is like merging all your scattered debts—credit cards, personal loans, and other outstanding balances—into one neatly packed loan. But is this a wise move for those with bad credit? Let's dive in. Debt consolidation aims for simpler, faster repayment by creating one singular debt from many. It's like putting all…

-

Financial Hardship Application Process

Understanding Mortgage Forbearance Mortgage forbearance grants you a temporary break from full payments. It's not a vacation for your wallet; you're still on the hook. Interest keeps accruing, and you'll eventually have to catch up. Think of it like a paused Netflix subscription—still there, waiting patiently, whether you're watching or not. Step 1: See if…

-

Understanding and Managing Debt

What is Debt? Debt is money borrowed that you must repay, usually with interest. It comes in various forms: Businesses use debt too, often issuing bonds to raise funds. Managing debt wisely is crucial. Prioritize paying high-interest debts first. Methods like the debt snowball (smallest debts first) or avalanche (highest interest first) can help accelerate…

-

Opening A Bank Account For Business: Requirements And Best Offers

If you’re running any kind of business – even a side hustle, freelance gig, or solo operation – you’ve probably heard you should have a separate business bank account. And maybe you’ve thought, “Ugh, sounds complicated.” Good news: it’s not as daunting as it seems, and honestly, it’s one of the smartest moves you can…

-

Top Credit Card Offers

Best Credit Card Offers: Top Rewards, Bonuses & Perks Credit card offers can feel overwhelming. Issuers constantly dangle enticing welcome bonuses, high reward rates, 0% APR periods, and premium perks. But which offers are truly “top tier,” and how do you choose the best one for your wallet? The secret is understanding that the “best”…

-

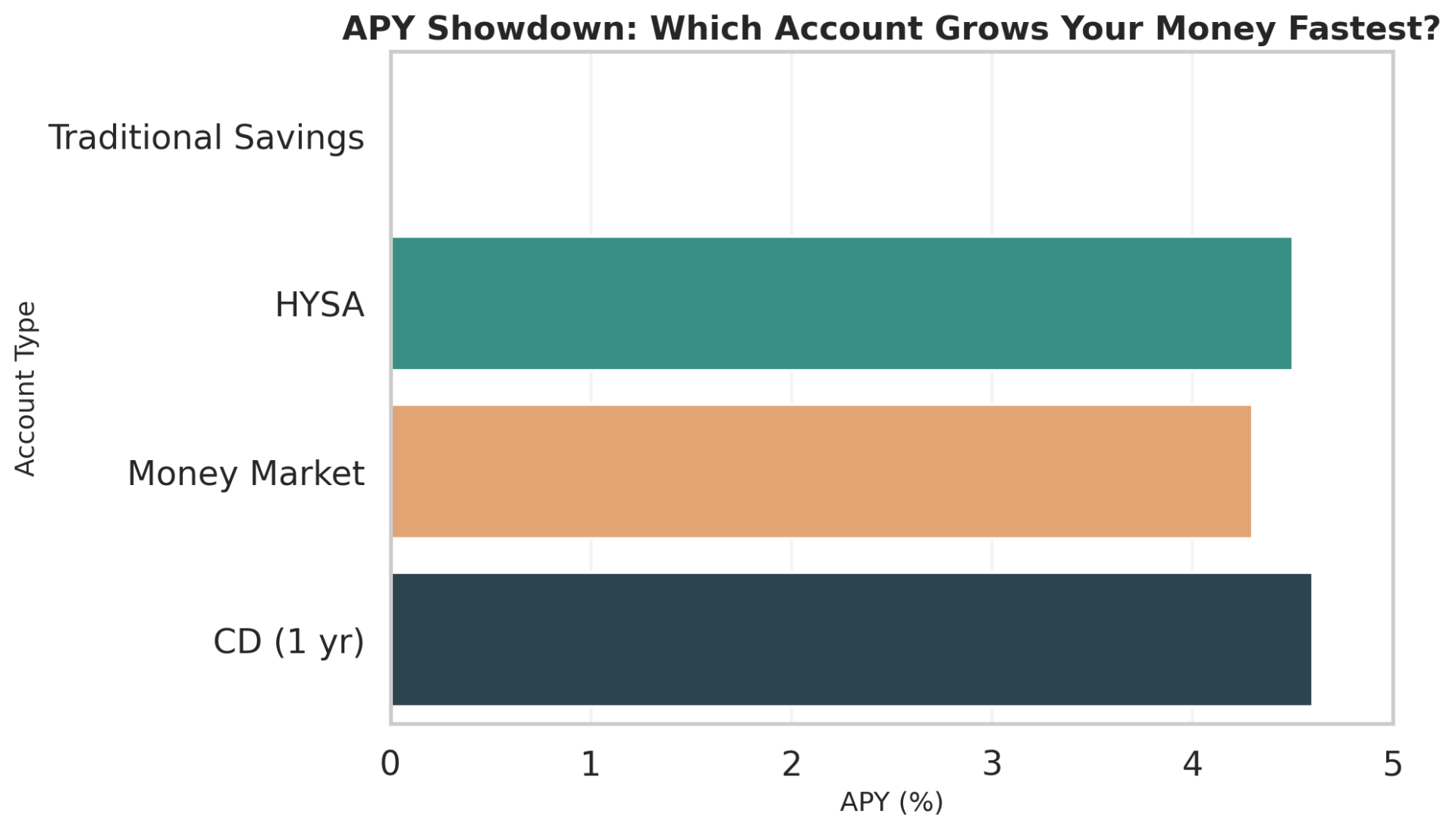

6 Savings Accounts For Best Interest Rates

In today’s financial landscape, finding the right savings account can be challenging. Each option offers a unique blend of features, rates, and conveniences that cater to different needs. As we consider various accounts, it’s important to focus on those that align with our goals and provide both growth and security. 6. Varo Online Savings: Automation…

-

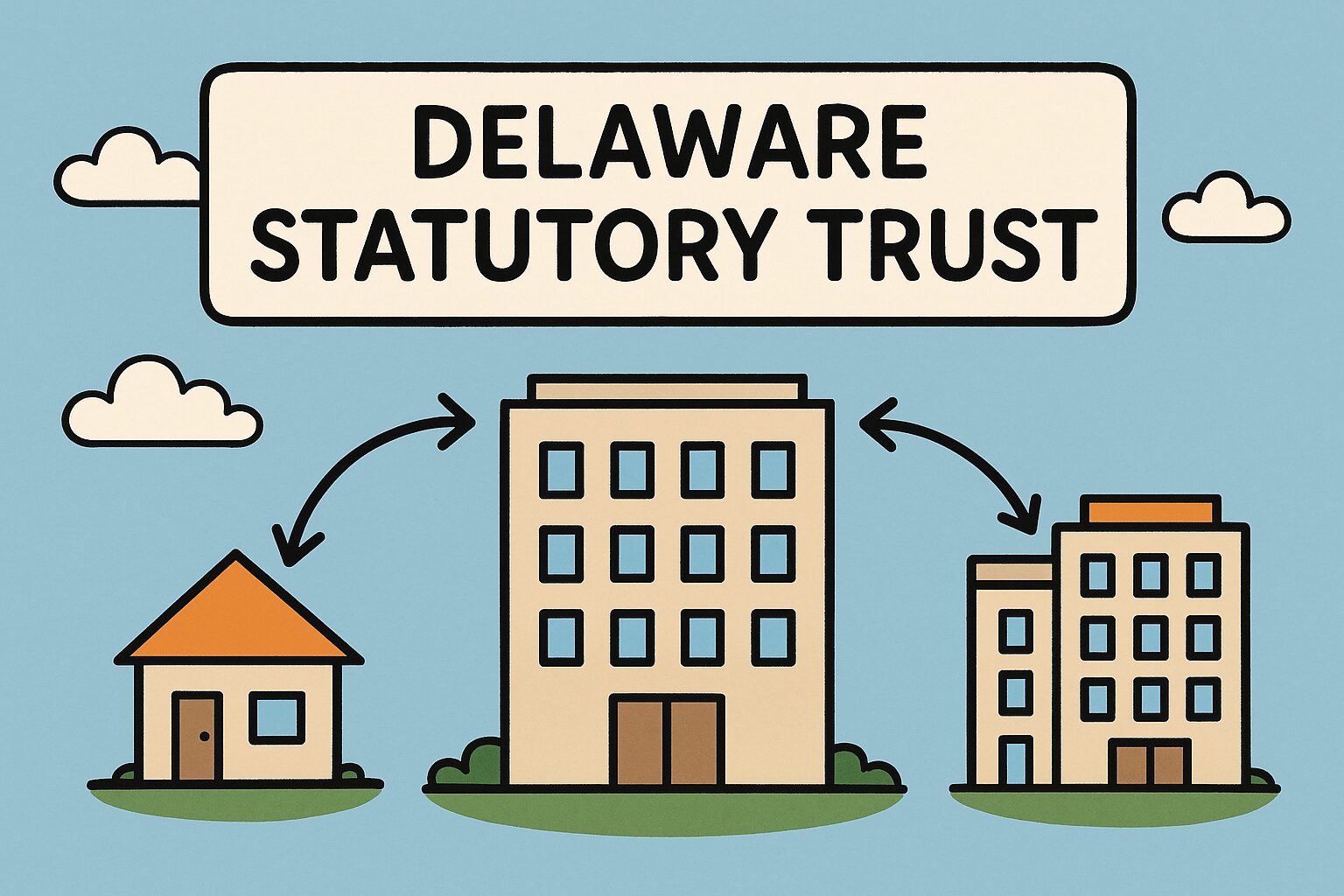

Top DST Real Estate Options

Guide to Delaware Statutory Trust (DST) Investments for Real Estate Investors For real estate investors looking to sell a property and defer capital gains taxes through a 1031 exchange, finding a suitable replacement property within the tight IRS deadlines can be challenging. Enter the Delaware Statutory Trust (DST). DSTs have become a popular solution, offering…

-

How To Get The Highest Deposit Rates

In a world where every dollar counts, maximizing the return on your savings is more important than ever. With interest rates fluctuating and inflation impacting purchasing power, understanding how to secure the highest deposit rates can make a significant difference in your financial journey. This comprehensive guide will walk you through the essentials of deposit…

-

Top Platforms for Options Trading

Choosing the right platform is critical for options trading success. Different brokers cater to different needs, balancing costs, tools, platform usability, and educational resources. Whether you’re a beginner making your first options trade or an advanced strategist managing complex positions, there’s a platform suited for you. This review covers some of the best options trading…

-

Top High-Yield Savings Accounts

If you’re looking for the best place to stash your cash while earning a little sweet, sweet passive income on the side, you’ve landed in the right spreadsheet. Let’s talk about high-yield savings accounts (HYSAs). These aren’t your grandma’s dusty passbook savings where your money naps in a corner earning 0.01%. We’re talking real, inflation-defying,…

-

Top Managed Retirement Accounts

Guide to Managed Retirement Account Options Stocks, bonds, funds, allocations… it’s a lot! If the idea of constantly researching, picking, and rebalancing investments sounds daunting, you might consider a “managed” approach. But what does that really mean, and which option is right for you? This guide will demystify the world of managed retirement accounts, exploring…

-

Top IRA Gold Investment Options

Exploring Gold IRA Investment Options Gold. For millennia, it’s held a certain allure – a tangible asset, a symbol of wealth, and for some investors, a potential shield against the stormy seas of inflation and economic uncertainty. While you can’t exactly stuff gold bars under your mattress and get tax benefits, a special type of…

-

Gold IRA Rollovers Guide

Understanding Gold IRAs Gold IRAs are self-directed IRAs that hold physical precious metals instead of traditional paper assets. They offer the same tax advantages as regular IRAs, but with a tangible twist. Only IRS-approved coins and bars meeting strict purity standards are allowed. The appeal? Tax benefits and potential hedge against inflation. Contributions grow tax-deferred…

-

1031 Exchange Insights & Common Pitfalls

Understanding 1031 Exchanges Imagine swapping your old baseball card for a shiny new one, but instead of cards, you’re dealing with real estate properties – and Uncle Sam lets you keep your tax savings! That’s what 1031 exchanges are all about: deferring capital gains taxes by switching one investment property for another like-kind one. But…

-

Best Cards for Debt Relief

Top Credit Cards for Debt Relief: Your Guide to 0% APR Offers Feeling the pressure of high-interest credit card debt? It’s a common struggle, and the interest charges alone can make it feel impossible to get ahead. But there’s a strategic tool designed specifically to help: the 0% intro APR balance transfer credit card. Think…

-

Choosing the Best Online Business Bank Account for Your Small Business

Running a small business means wearing many hats, and managing finances shouldn’t add unnecessary complexity or cost. Traditional brick-and-mortar banks have long been the default, but modern online business bank accounts offer compelling alternatives, often with lower fees, seamless digital experiences, and features tailored specifically for entrepreneurs and freelancers. This guide will explore the landscape…

-

Top 10 Savings Accounts for Maximum Growth

Why You Should Care About Where Your Savings Go Most people know they should be saving money, but far fewer understand how dramatically the location of their savings can influence long-term outcomes. Sticking your money in a standard bank savings account might feel safe, but it can mean losing hundreds – or thousands – of…

-

Top 10 High-Yield Checking Account Options

High-yield checking accounts are a hybrid financial product that combines the everyday functionality of a traditional checking account with the interest-earning potential typically associated with savings accounts. These accounts offer higher-than-average interest rates (APYs) on your checking balance, provided you meet certain criteria such as maintaining a minimum balance, making a specific number of debit…

-

Your Comprehensive Guide to Retirement Strategies and Account Options

Planning for Your Future: Why Retirement Strategy Matters Retirement might seem like a distant destination, but planning for it now is the single most powerful lever you have to shape that future. Think of it like packing for a long trip – careful foresight is essential. This guide is your roadmap. We’ll navigate the landscape…

-

Top 12 Traditional Interest Savings Accounts

Let’s talk about the OG of banking: traditional savings accounts. Are they flashy? Nope.Are they going to double your money in a year? Definitely not.But are they reliable, safe, and still useful in the right situations? You bet your direct deposit they are. While high-yield savings accounts (HYSAs) are grabbing the headlines (and rightfully so),…

-

2025 Guide to Opening a High-Yield Savings Account Online

So you’ve heard whispers about “high-yield savings accounts” (HYSAs), maybe from a personal finance subreddit, a YouTube video, or your friend who suddenly started saying “APY” like it’s a lifestyle. Here’s the deal: a HYSA is one of the few no-brainer financial moves that actually feels smart. You park your cash → it earns interest…

-

Top 14 Travel Miles Credit Cards

Best Travel Miles Credit Cards: Unlock Your Next Adventure (2025) Dreaming of sipping Mai Tais in Maui or exploring ancient ruins in Rome, funded largely by your everyday spending? That’s the magic of travel rewards credit cards! These cards turn your purchases into points or miles that can unlock flights, hotel stays, and amazing travel…

-

Top 5 Futures Trading Platforms

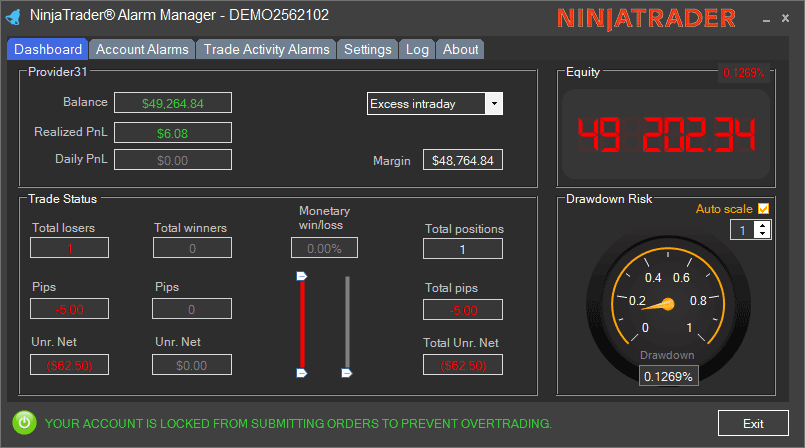

In the shifting landscape of investing, finding a trading platform that aligns with your strategy is crucial. Whether you’re a seasoned trader or just starting out, understanding what each platform offers can help you make informed decisions without falling for flashy promises. 5. NinjaTrader NinjaTrader is a powerful platform built for serious futures traders. Launched…

-

Best 1031 Exchange Investments

Choosing Your Best 1031 Exchange Investment Strategy Selling an investment property often comes with a significant capital gains tax bill. Ouch. But Section 1031 of the IRS code offers a powerful escape hatch: the ability to defer those taxes by reinvesting the proceeds into a new, “like-kind” investment property. The catch? You have to follow…

-

Top Term Life Insurance Policies

Finding the Best Term Life Insurance Policy: A Guide to Top Options Life insurance might not be the most exciting topic, but it’s one of the most important financial safety nets you can provide for your loved ones. If people depend on you financially, term life insurance offers a straightforward and typically affordable way to…

-

Open High-Yield Savings Accounts

Understanding High-Yield Savings Accounts High-yield savings accounts offer interest rates that significantly outperform regular savings accounts. While traditional savings accounts might offer around 0.41%, high-yield alternatives often boast rates exceeding 4%. This means your money grows faster without additional effort on your part. Safety is a key feature of these accounts. Most are backed by…

-

Top Whole Life Insurance Plans

5. Penn Mutual: A Legacy of Dividends Penn Mutual's rich history in paying dividends isn't just a footnote—it's their standout feature. While some companies are all talk, Penn Mutual quietly delivers, focusing on solid financial returns for policyholders. Their record of consistent dividend payments speaks volumes. Practicality underlines the appeal here. The focus is on…

-

Top High-Interest Accounts

Financial decisions require a blend of foresight and practicality. When considering options for saving and growing your money, it's essential to weigh the benefits and potential drawbacks of each choice. Whether you're looking at Certificates of Deposit (CDs), online banks, or high-yield savings accounts, understanding their unique features can help you make informed decisions that…

-

Top Credit Card Cash Bonuses

Maximizing Value: Best Credit Card Cash Bonus Offers Getting paid to spend money you were going to spend anyway? That’s the allure of credit card cash sign-up bonuses! Issuers offer these lucrative welcome bonuses – often $150, $200, or even more – to attract new customers. While it sounds like free money (and it can…

-

Top Brokerage Accounts for Beginners

Choosing Your First Online Brokerage Account: Top Options for New Investors Ready to dip your toes into the world of investing but feeling a bit lost about where to start? You’re not alone! Choosing your first online brokerage account is a crucial first step. Think of it as selecting your mission control center for buying…

-

What Makes a “Good” Retirement Strategy Plan

Let’s talk about retirement planning – not the glossy brochure version with beaches and golden sunsets, but the real version. The kind where you’re not just hoping it all works out, but actually building a strategy that adjusts, holds up, and pays off over time. Because here’s the truth: most retirement plans aren’t really plans.…

-

Platinum Credit Card Guide

Platinum Credit Cards Explained: A Beginner’s Guide to Premium Perks You’ve probably seen them – those sleek, often metal credit cards casually dropped on restaurant tables or flashed at airport lounges. You might have heard terms like “Platinum” or “Reserve” thrown around. They sound exclusive, maybe even a little intimidating. What’s the actual deal with…

-

Top High-Interest Accounts

Understanding High-Yield Savings Accounts High-yield savings accounts offer significantly higher APYs compared to traditional savings accounts, often exceeding 4% versus the average 0.41%. This difference allows for more substantial growth of savings over time due to compound interest. Key features of high-yield savings accounts include: When comparing accounts, consider: Evaluating the Best High-Yield Savings Accounts…

-

Top APY Savings Rates

What Are High-Yield Savings Accounts? High-yield savings accounts offer interest rates significantly higher than regular savings accounts. While a standard account might give you a fraction of a percent, high-yield accounts can offer rates five to ten times the national average. The Federal Reserve’s actions influence these rates. When they cut the federal funds rate,…

-

Top 10 High-Yield Savings Accounts

Finding the best place to grow your savings is crucial, especially with interest rates fluctuating. High-yield savings accounts (HYSAs) offer significantly better returns than traditional savings accounts, while still keeping your money safe and accessible. Here’s a look at some of the top HYSAs available as of April 11, 2025, based on their Annual Percentage…

-

Top High-Yield Savings Account By Rates

Savings accounts are one of the most basic financial tools, but don’t let their simplicity fool you – they’re incredibly useful and worth optimizing. In essence, a savings account is a place to store money you don’t need for day-to-day expenses, while earning a small return on your balance over time. Banks and credit unions…

-

Retirement Investment Planning

Retirement planning isn't just about crunching numbers or selecting the right investment vehicles. It's about aligning your financial strategy with your personal aspirations, ensuring that your golden years are as fulfilling as you envision. From tax strategies to investment diversification, each element plays a crucial role in crafting a plan that stands the test of…

-

1031 Exchanges Explained

Your Simple Guide to Saving Taxes Sold an investment property for a nice profit? Awesome! Facing a potentially huge tax bill on that profit? Not so awesome. If only there were a way to postpone paying those taxes and keep your hard-earned money working for you… Well, there is! It’s called a 1031 exchange, and…

-

Build the Best Portfolio

Determine Your Asset Allocation Building your portfolio isn’t a one-size-fits-all affair. Let’s discuss how much risk you’re willing to stomach. Can you handle your portfolio diving one day and skyrocketing the next without losing sleep? If so, you might lean heavily into stocks. If swings make you uneasy, bonds might be more your speed. Consider…

-

Top No Interest Balance Transfer Cards

Best 0% Intro APR Balance Transfer Credit Cards Feeling weighed down by high-interest credit card debt? You’re not alone. Carrying a balance on cards with typical APRs (Annual Percentage Rates) often exceeding 20% can feel like trying to swim upstream. Thankfully, balance transfer credit cards offer a powerful tool: a temporary period where you pay…

-

Best Fixed Index Annuity Rates

Fixed Index Annuities & Finding the ‘Best’ Rates: A Simple Guide Heard about an investment that offers the chance to grow your money based on market index gains (like the S&P 500) but without the risk of losing your principal if the market crashes? Sounds appealing, right? That’s the core promise of a Fixed Index…