In the shifting landscape of investing, finding a trading platform that aligns with your strategy is crucial. Whether you’re a seasoned trader or just starting out, understanding what each platform offers can help you make informed decisions without falling for flashy promises.

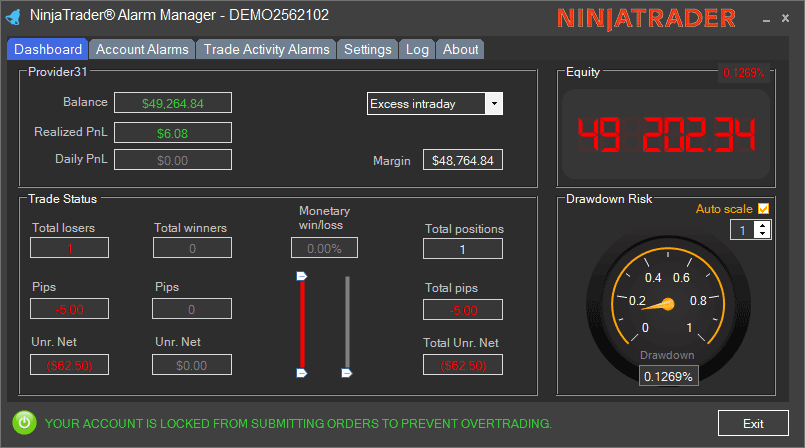

5. NinjaTrader

NinjaTrader is a powerful platform built for serious futures traders. Launched in 2003, it offers sleek interfaces on desktops, mobile, and web, keeping you connected to the trading atmosphere wherever you are.

NinjaTrader’s pricing is wallet-friendly, with three structures ranging from no monthly fees to a one-time lifetime payment. You can practice in a simulated account without risking real money, which is great for those carefully entering futures trading.

Chart enthusiasts will appreciate NinjaTrader’s customizable and interactive charts. You can trade directly from these charts, perfect for executing quick decisions. Various analytical add-ons make your trading life less stressful and more exciting.

NinjaTrader offers competitive intraday margins, which can ease some anxiety around trading. While their overnight margins align with industry norms, in-day trades enjoy lower rates.

Although NinjaTrader doesn’t offer options or direct equity trading, it allows connectivity with popular brokers like Interactive Brokers. It also ventures into forex trading through collaborations with players like FXCM. Keep in mind that live futures trading data costs extra.

With 24-hour support during trading days, NinjaTrader is a solid choice in the futures trading arsenal, offering tools, adaptability, and cost-effectiveness to keep you on your toes and hopefully in the green.

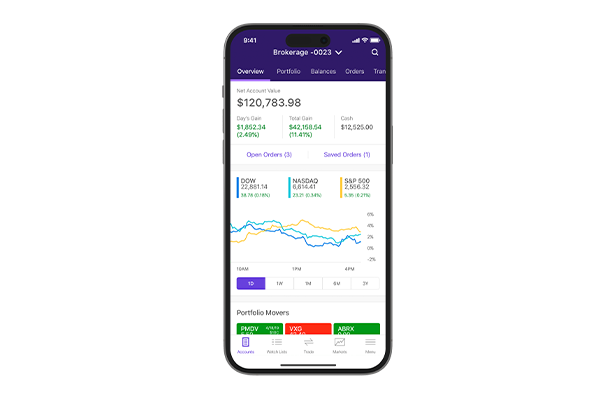

4. E*TRADE

E*TRADE stands out for its top-tier educational materials, making it an excellent choice for those new to futures trading. It offers a wealth of guides, videos, and concise articles that translate futures jargon into plain English.

The platform combines a user-friendly interface with serious functionality, offering various U.S. asset classes including stocks, ETFs, and cryptos alongside futures. This allows for a seamless trading experience across different investment types.

While futures margin requirements might be slightly higher, E*TRADE offers a simulated account where beginners can explore, learn, and make mistakes without financial consequences.

- Extensive educational content

- User-friendly trading platforms

- Multiple U.S. asset classes supported

- Simulated account for practice

E*TRADE may not offer international asset classes, but within U.S. markets, its sturdy infrastructure proves why it’s a favorite for those new to futures. You’re equipped with knowledge and resources to navigate even the most complex Wall Street jargon.

With mobile trading capabilities, you can access your trading lessons and strategies on the go. Whether you’re plotting your next move or just honing your skills, E*TRADE provides the tools, knowledge, and inspiration to guide your path to trading proficiency.

3. TradeStation

TradeStation is a sophisticated platform packed with features for traders who like complete control over their environment. It offers impressive execution speeds across equity indexes, commodities, and even cryptocurrency.

Designed for advanced traders, TradeStation provides a suite of tools for those who treat trading as a serious business. Its charting capabilities are extensive, offering:

- Custom indicators

- Numerous drawing tools

- Multiple data points

You can backtest strategies against years of data, making it a true trading lab.

Order entry is where TradeStation really shines, providing an elaborate setup for complex trades. Advanced order types, flexible trade automation capabilities, and customization options allow you to tweak your trades quickly and efficiently.

However, TradeStation comes with a steep learning curve, requiring new users to familiarize themselves with a detailed and occasionally challenging interface. While customer service might not be its strongest point, the platform makes up for it with sheer functionality once mastered.

TradeStation offers demo account access, allowing you to test and refine your strategies before risking real capital. Whether it’s futures, stocks, or ETFs, TradeStation caters to traders who appreciate nuance and sophistication in their trading tools.

2. Interactive Brokers

Interactive Brokers is the heavyweight champion of professional futures trading. Founded in 1978, it caters to serious traders who view trading as a formulaic conquest rather than a hobby.

The platform’s market breadth is unmatched, providing access to a vast array of global markets including stocks, bonds, and futures. This extensive offering is coupled with competitive pricing, featuring low commissions and volume-based discounts.

What really sets Interactive Brokers apart is its trading technology. The platform offers:

- Advanced algorithms

- Backtesting tools

- Comprehensive educational resources

All bundled into a powerful package.

Be aware that Interactive Brokers comes with a learning curve. It’s an environment where seasoned pros thrive, while newcomers might initially feel overwhelmed. The challenge is part of the appeal—it’s how experts develop strategies that work across various markets, using powerful APIs to automate trades efficiently.

With cutting-edge execution and substantial volume discounts, Interactive Brokers is a powerhouse platform for traders who don’t shy away from complexity. Whether you’re local or global, it offers a robust trading experience for those bold enough to tackle its opportunities head-on.

1. FMX Exchange

FMX Exchange is a newcomer set to challenge the market heavyweight CME Group. It offers an integrated system that seamlessly blends U.S. Treasury, FX, and SOFR futures into one package.

Backed by financial giants like Bank of America and JPMorgan Chase, FMX brings credibility to the table. The platform aims to reshape competitive dynamics with smaller tick sizes and lower exchange fees, helping traders maximize their capital efficiency.

"FMX's Fenics trading technology offers a fast, seamless experience suited to today's traders, ensuring finality in trades without 'last looks'."

This allows for the execution of intricate strategies with uninterrupted trade flows.

However, FMX still needs to prove it can compete with CME’s dominance. As a new entrant in the futures exchanges arena, it stands poised to carve out its own legacy with pioneering fintech, institutional backing, and a drive to innovate.

With its focus on lower costs, deeper liquidity, and advanced technology, FMX might just be the platform to watch for traders looking to stay ahead in the evolving futures market.

Choosing a trading platform ultimately comes down to finding one that fits your style and goals. It’s about building strategies grounded in data and logic, not chasing trends. As you explore your options, focus on making smart moves that keep you ahead in the game.

- Chicago Mercantile Exchange Group. CME Group Reports Record Trading in 2023 and 2024. CME Group Newsroom. 2024.

- Commodity Futures Trading Commission. CFTC Approves FMX Futures Exchange. CFTC Press Releases. 2024.

- BGC Group Inc. BGC Launches FMX Futures Exchange. BGC Investor Relations. 2024.